As fraudulent platforms like Medieval Credit Bank continue to emerge, they prey on unsuspecting investors with promises of high returns and secure financial services. However, serious concerns have surfaced about this entity’s legitimacy, transparency, and operational integrity. Investors are strongly advised to remain vigilant and take steps to protect their assets.

Trace Your Lost Funds

Been scammed by an online company? We specialize in uncovering complex financial fraud and tracing lost assets. Don’t let scammers take away your hard-earned money. Take the first step toward justice—get a free consultation with CNC Intelligence by completing the form below.

What Are the Warning Signs with Medieval Credit Bank?

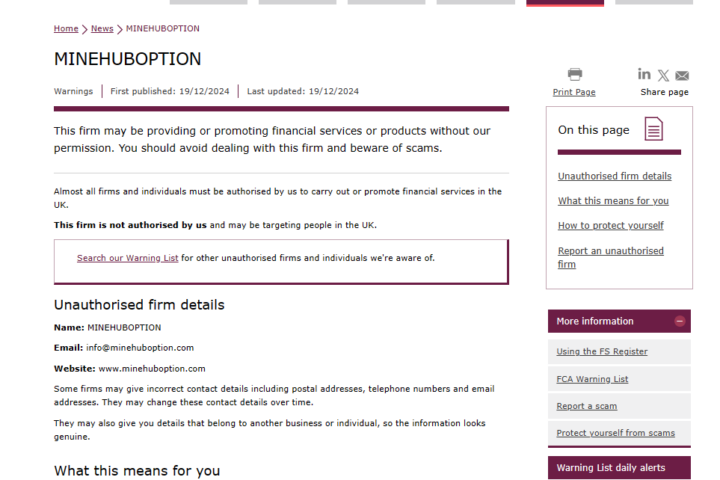

Although Medieval Credit Bank claims to be a reliable financial institution, several red flags highlight why investors should approach with caution:

- Unrealistic Returns: Guaranteed high profits with minimal or no risk are often indicative of scams designed to lure in investors.

- Lack of Regulatory Compliance: The platform’s licensing, adherence to regulatory standards, and other credentials are either unclear or missing.

- Investor Complaints: Reports from users include difficulties accessing funds, lack of responsiveness from support teams, and sudden account freezes.

- Data Security Concerns: Questionable practices in handling personal and financial data leave investors vulnerable to identity theft and fraud.

The Risks of Dealing with Medieval Credit Bank

Engaging with platforms like Medieval Credit Bank can result in severe consequences:

- Complete Financial Loss: Many victims report losing their investments entirely, with little to no hope of recovery.

- Compromised Personal Information: Providing sensitive data may expose you to identity theft or unauthorized transactions.

- Loss of Trust in Financial Systems: Falling victim to such schemes can deter investors from exploring legitimate opportunities in the future.

How to Protect Yourself from Investment Scams

Here’s how you can safeguard your investments and avoid fraudulent platforms:

- Conduct Due Diligence: Verify the platform’s credentials, including licensing and regulatory compliance, through trusted sources.

- Avoid Unrealistic Offers: If an offer sounds too good to be true, it likely is. Exercise caution when presented with guaranteed returns.

- Consult Financial Experts: Professionals can help assess the risks and steer you toward credible investment opportunities.

How Our Portal Can Help

Navigating today’s complex financial landscape requires informed decision-making. Our portal offers access to seasoned financial advisors who can:

- Investigate the credibility of platforms like Medieval Credit Bank.

- Provide customized strategies tailored to your financial goals.

- Help build a secure, diversified portfolio to minimize risks and maximize potential growth.

Final Thoughts on Medieval Credit Bank

Medieval Credit Bank serves as a reminder of the increasing sophistication of financial scams. Protect your hard-earned money by staying informed, conducting thorough research, and seeking professional guidance before making any commitments.

Visit our portal today for reliable financial advice and personalized support. Together, we can help you make safe, informed decisions and confidently achieve your financial objectives.

Tips on Fighting Back Against Disinformation

Disinformation—false or misleading information intentionally spread to deceive—can have serious consequences, from sowing societal discord to enabling financial scams. Fighting back requires vigilance, critical thinking, and proactive measures. Here are practical tips to help combat disinformation effectively.

1. Verify Before Sharing

Why It Matters:

Sharing false information amplifies its reach and credibility. Verifying content before sharing is the first line of defense against disinformation.

How to Verify:

- Check the Source: Reliable information typically comes from reputable and recognized organizations. Be wary of anonymous or questionable sources.

- Look for Corroboration: Cross-check the information with other credible sources to ensure consistency.

- Use Fact-Checking Websites: Platforms like Snopes, PolitiFact, and FactCheck.org specialize in debunking disinformation.

2. Understand Common Tactics

Why It Matters:

Recognizing disinformation tactics can help you spot red flags and avoid being misled.

Common Tactics Include:

- Clickbait Headlines: Overly sensational or emotionally charged titles.

- Deepfake Media: Manipulated videos or images designed to deceive.

- Fake Accounts: Bots or fake profiles spreading false narratives.

3. Evaluate Emotional Triggers

Why It Matters:

Disinformation often plays on emotions like fear, anger, or excitement to encourage impulsive reactions.

What to Do:

- Pause and reflect before reacting to emotionally charged content.

- Ask, “Is this designed to provoke a specific reaction?”

4. Report Disinformation

Why It Matters:

Reporting false content helps reduce its spread and holds perpetrators accountable.

Where to Report:

- Social media platforms like Facebook, Twitter, and Instagram have reporting tools for flagging false or harmful content.

- Local authorities or regulatory bodies for scams or fraudulent activity.

5. Educate Yourself and Others

Why It Matters:

Education empowers individuals to recognize and resist disinformation.

How to Educate:

- Stay informed about common scams and fake news trends.

- Share your knowledge with friends, family, and your community to build collective awareness.

6. Strengthen Digital Literacy

Why It Matters:

Digital literacy equips you with the skills to critically assess online content.

Key Skills to Develop:

- Spotting Fake News: Learn to differentiate between authentic journalism and propaganda.

- Understanding Algorithms: Know how platforms amplify certain types of content.

- Fact-Checking Techniques: Familiarize yourself with tools and methods to verify information.

7. Use Secure Tools and Settings

Why It Matters:

Scammers often exploit technological vulnerabilities to spread disinformation and target individuals.

How to Stay Secure:

- Use up-to-date antivirus software and firewalls.

- Enable two-factor authentication (2FA) on all accounts.

- Be cautious of unsolicited emails, links, or attachments.

8. Promote Credible Sources

Why It Matters:

Amplifying credible sources reduces the influence of false information.

What to Share:

- Links to reputable news outlets or fact-checked articles.

- Official updates from trusted organizations or government bodies.

9. Advocate for Transparency

Why It Matters:

Encouraging transparency in media and technology helps reduce the prevalence of disinformation.

How to Advocate:

- Support policies or platforms that prioritize content moderation and fact-checking.

- Demand accountability from social media platforms and tech companies.

10. Stay Skeptical

Why It Matters:

Maintaining a healthy skepticism helps you approach information critically rather than blindly trusting it.

Questions to Ask:

- Who created this content, and why?

- Is the information backed by evidence or data?

- Could this be satire or parody?

FAQs: How Scams Like Medieval Credit Bank Use Disinformation

1. What is disinformation in the context of scams?

Disinformation refers to false or misleading information intentionally spread by scammers to deceive, manipulate, or exploit individuals. It can take many forms, such as fake news, manipulated media, or fraudulent claims, all designed to mislead victims and achieve the scammer’s goals.

2. How do scammers use disinformation to target victims?

Scammers use disinformation to:

- Create fear, urgency, or excitement to prompt impulsive actions.

- Fabricate convincing narratives, like pretending to represent trusted organizations.

- Manipulate emotions, such as sympathy or greed, to influence decision-making.

- Spread fake reviews or endorsements to build false credibility.

3. What platforms do scammers use to spread disinformation?

Scammers exploit a variety of platforms, including:

- Social Media: Fake posts, ads, or viral hoaxes.

- Email and Messaging Apps: Phishing emails or smishing (SMS phishing).

- Websites: Counterfeit domains mimicking legitimate organizations.

- News Outlets: Fake press releases or articles on less-regulated news websites.

- Forums and Communities: False information spread in online discussion boards or groups.

4. What are some examples of disinformation scams?

Examples include:

- Investment Scams: Fake opportunities promising high returns, supported by fabricated success stories.

- Health Scams: False cures or treatments for diseases, often during crises like pandemics.

- Tech Support Scams: Alerts claiming viruses or issues with your device, urging immediate action.

- Charity Scams: Fake charities using emotional stories to solicit donations.

- Romance Scams: Fake profiles sharing disinformation to gain trust and request money.

5. How do scammers make their disinformation believable?

Scammers use tactics like:

- Mimicking Trusted Brands: Copying logos, designs, or language from reputable organizations.

- Social Proof: Posting fake reviews, testimonials, or endorsements.

- Emotional Manipulation: Using urgent or fear-inducing language.

- Deepfakes and Edited Media: Creating convincing fake videos or images.

- Partial Truths: Incorporating bits of real information to add credibility.

6. Why is disinformation effective in scams?

Disinformation works because it:

- Exploits cognitive biases, like trust in authority or herd mentality.

- Spreads quickly, especially on social media, reaching large audiences before it’s debunked.

- Preys on emotions, overriding rational thinking.

- Uses technology like AI to craft realistic but false content.

7. How can I spot disinformation used in scams?

To identify disinformation:

- Verify Sources: Check the legitimacy of the sender or website.

- Look for Red Flags: Poor grammar, overly emotional language, or unverified claims.

- Check URLs: Ensure links lead to secure, official websites.

- Use Fact-Checking Tools: Platforms like Snopes or FactCheck.org can confirm the validity of claims.

- Be Skeptical of Urgency: Scammers often pressure you to act quickly without thinking.

8. What should I do if I suspect disinformation in a scam?

If you encounter potential disinformation:

- Stop and Think: Don’t act immediately on emotionally charged or urgent messages.

- Report It: Alert relevant authorities, such as regulatory bodies or the platform where the scam appeared.

- Warn Others: Share information with your network to prevent others from falling victim.

- Seek Expert Help: Contact professionals to guide you in verifying claims or recovering lost funds.

9. Can disinformation from scams be harmful even if I don’t act on it?

Yes, disinformation can harm society by:

- Undermining trust in legitimate institutions.

- Spreading confusion and fear.

- Influencing decision-making based on false premises.

- Damaging reputations of legitimate organizations or individuals.

10. How can I protect myself from scams using disinformation?

Protect yourself by:

- Staying informed about common scam tactics.

- Regularly updating your devices and using security tools.

- Avoiding unsolicited communications and links.

- Verifying all financial or personal requests with trusted sources.

- Educating others about the risks of disinformation in scams.

By understanding how scammers leverage disinformation, you can better safeguard yourself and your community from falling victim to these deceptive schemes.